After years of experience in his field, Dr. Jules Walters opened his own private practice, the MODERN Plastic Surgery and MedSpa in Metairie, Louisiana, in January 2020. He saw this as the fulfillment of his goal to create a practice that offers patients modern results in a modern atmosphere. From his new state-of-the-art facility, Dr. Walters performs the latest treatments in both cosmetic surgery and reconstructive breast surgery as well as nonsurgical skin rejuvenation.

Managing the day-to-day operations of the practice is Practice Manager Ashley Barnes. When Ashley realized that their old payments solution no longer fit the modern, cutting-edge feel of their new practice, she knew it was time for a switch.

Before adopting Nextech Payments, Dr. Walters, Ashley Barnes, and their staff had been using Nextech EMR and Practice Management (PM) for over five years. They chose to continue doing so when they opened the MODERN Plastic Surgery and Medspa. In the previous practice, they had been using a payments solution that did not integrate with their Nextech EMR/PM. When they opened the new practice, they began using a third-party payments solution to accept/process payments.

“The somewhat integrated solution was helpful, but we were still using it half on the website and half in the Nextech integration,” said Barnes. “We didn’t have a card reader terminal at every desk, and the previous solution didn’t allow us to accept payments away from the terminals other than on the website.”

They also found themselves restricted by outdated and overpriced hardware that offered little to no value for the exorbitant cost. “The card readers we had were very antiquated,” Barnes explained. “They felt like something from back in 1985. They were ugly, bulky, and tethered by wires, which really didn’t match the modern aesthetic of our practice. To make matters worse, they were ridiculously expensive.”

The outdated equipment also hindered their ability to process card-not-present transactions quickly and easily. “Card-not-present transactions required us to be on the website or standing right next to a wired terminal,” said Barnes, “which was extremely inconvenient.”

Ashley Barnes

Practice Manager

Ashley Barnes

Practice Manager

Any time a practice is switching to a new solution, a certain amount of anxiety is to be expected. The situation was made even more concerning for Barnes, as she would soon be away from the office for a week.

“To my happy surprise, the transition was totally painless. We received our card readers and full instructions, which made setup super easy. After that, we had about a 30-minute training call and were ready to go.”

“Even though a number of staff members were not able to attend the training call, the user-friendliness of Nextech Payments made it simple to get them all up to speed,” said Barnes.

Mobile & Seamless Payments

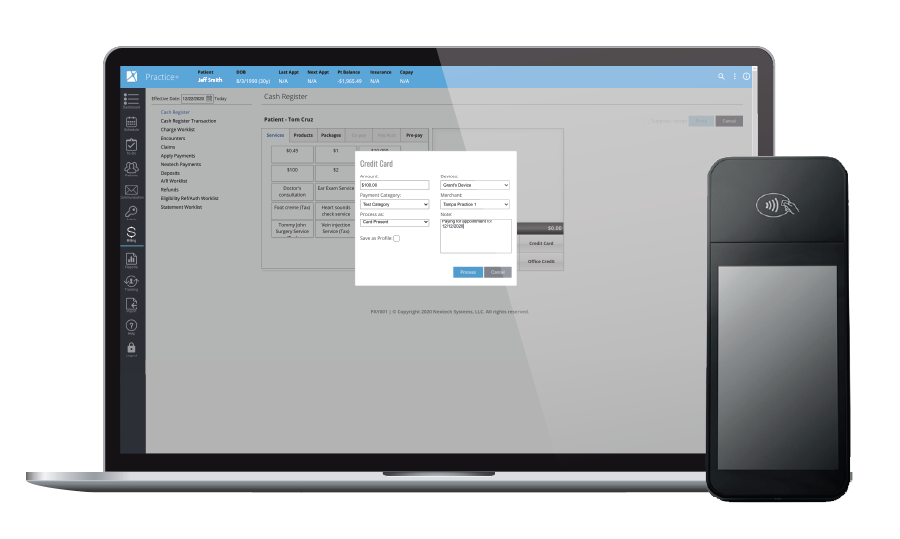

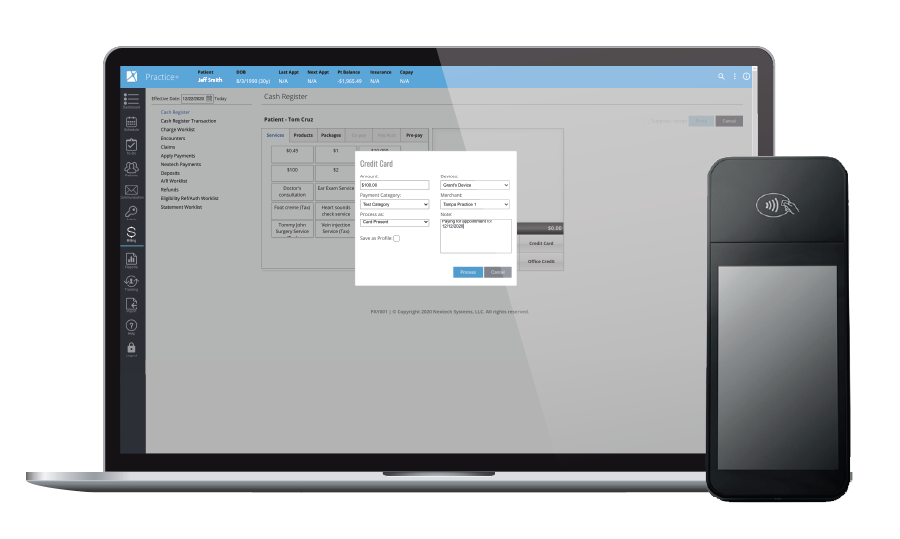

Mobile & Seamless Payments “Now that we have Nextech Payments, everyone does everything within one system,” said Barnes. “When we schedule an appointment, we can create a payment profile directly in Nextech so the patient’s credit card is securely on file. It lets us easily make charges per our cancellation policy. These secure payment profiles also allow repeat patients to just have a card on file, so they don’t have to pull the card out every time. Nextech Payments has really streamlined the whole checkout process.”

Nextech Payments has provided them with more than just a better solution, but also better hardware with state-of-the-art capabilities.

“We didn’t have the ‘tap and pay’ feature on the old ones,” said Barnes. “So not only are they wireless and faster, but each card reader was less expensive than our older ones. They also give us more ways to accept payments quickly and on the spot. If I need to run a card, I can just grab a wireless terminal and bring it to my office or the exam room or wherever else.”

The modern terminals also eliminated the issues they experienced previously when making card-not-present transactions with the outdated hardware of their old vendor. As Barnes explained, “Many patients don’t book their procedures at the office and call back the next day to put down a deposit. For these situations, the card-not-present feature makes everything really simple.”

“So many of our processes have been simplified since we switched,” said Barnes. “Previously, we had to run a separate ICCP report on the virtual terminal website, and then we had to make sure everything was matching up. When things did not match up, it became a huge ordeal trying to reconcile what happened. Now that we have Nextech Payments, this issue has been eliminated.”

In addition to simplified reconciliation and faster payment processing, monthly accounting reports are no longer the multi-step chore they once were. “It’s just a straightforward report that I can pull right out of Nextech,” explained Barnes.

As processes are streamlined and efficiency obstacles removed, the staff at MODERN experienced almost immediate time savings. As Barnes put it, “At minimum, Nextech Payments is saving our staff several hours a week. When we have a discrepancy or error, it is far easier to locate and identify since everything is in one system.”

In addition to workflow improvements and time savings, they have also experienced positive impacts to their financials as a result of Nextech’s competitive rates. The attentive and responsive technical support team delivered during both implementation and after go-live.

“With our old solution, it was difficult to get in touch with an actual person when we ran into problems,” said Barnes. “With Nextech Payments, we know exactly who to contact when we have questions, and our customer service experience has been spot on.”

“I honestly can’t think of a single negative thing to say about Nextech Payments,” Barnes concluded. “Since starting this new practice, we’ve dealt with a lot of different vendors and companies, and many have been a real headache to deal with. Having something go as smoothly as this has with Nextech has been a breath of fresh air.”