Latest Articles

The latest news and information regarding electronic medical records, practice management software, HIPAA, and security from Nextech.

By:

Nextech

May 7th, 2015

Whether you've just started your own medical practice or have been a leader in your respective field for years, it's important to recognize that revenue cycle management is one of your foremost concerns. Keeping a close eye on your incoming revenue streams and outgoing budget will allow you to understand where your practice's money is moving, but viewing this data more analytically can do even more for you. Ideally, you should regularly be taking time to observe your practice from a high-level viewpoint with the intention of identifying new sources of profit. The process of identifying new revenue streams can be made a great deal easier with these helpful tips:

Regulatory & Compliance | Financial Management

By:

Nextech

March 26th, 2015

Even with the most effective medical billing software, all medical practices experience some level of claim denials (when insurance companies refuse to honor requests for health care coverage). According to the American Academy of Family Physicians, the average denial rate for providers is between 5 and 10 percent. However, the general goal is to keep that number below 5 percent, as a lower denial rate means a more abundant cash flow.

By:

Nextech

February 26th, 2015

Between keeping up with advances in modern medicine, establishing meaningful and healthy relationships with your patients and dealing with the day-to-day grind of running a business, it can be hard to make time to think critically about revenue cycle management. Still, it's important to remember that having a clear understanding of your various revenue streams and financial management techniques is key to the longevity and success of your practice. Luckily, this need not be quite as difficult an undertaking as it may first seem. In fact, pairing strong organizational techniques with effective practice management software can make financial evaluation a breeze. Take a look at these best practices for managing the financial health of your practice:

By:

Nextech

January 22nd, 2015

Revenue management is essential to the health care industry, as it helps manage claims, and controls payment and cash flow. It ensures that the billing process goes smoothly to generate adequate revenue to invest further in your business. Therefore, your practice should always be striving to improve revenue cycle management. Here are a few ways you can better revenue management to build a more profitable practice: 1. Keep track of Medicare payments It's not unusual for Medicare to delay payments to providers, which could result in money lost for your practice. The reason behind the delay could be due to a claim that was improperly coded or insufficient documentation. Be sure to identify the exact date that Medicare stops or delays payment. This way, your practice can take the appropriate steps to receive those payments that are due. Your practice can enroll in a medical review program, which consists of a clinician or certified coder reviewing Medicare claims to reduce payment error. They identify and address billing errors regarding coverage and coding.

By:

Nextech

January 13th, 2015

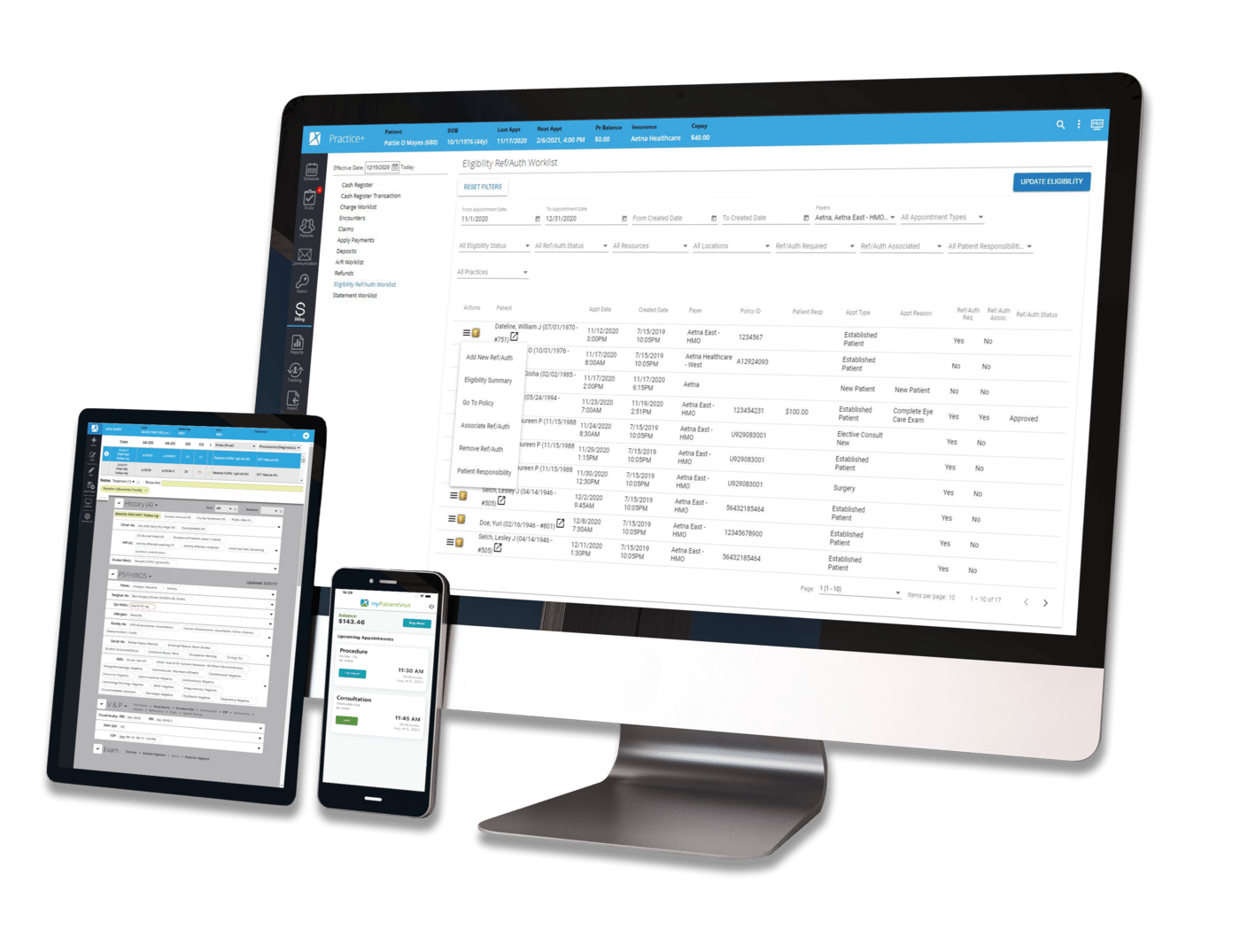

We've posted previously about the benefits of e-eligibility services for specialists. The core reason for adopting an e-eligibility service is that it enables a practice to communicate accurately to patients, prior to administering care, their responsibility for the cost of care. Having that determined early on paves the way for collecting up-front patient payments – a practice steadily gaining momentum as patients take a more active role in paying for their healthcare.

By:

Nextech

January 7th, 2015

We recently blogged about best practices for electronic eligibility (e-eligibility) as a means to protect a practice’s revenue cycle by minimizing the need for post-care patient collections. Similarly for specialists who rely on insurance reimbursements from public or private payers, a clearinghouse electronic remittance (e-remittance) service is essential to making sure the practice receives full compensation from payers for services rendered. Healthcare payers have successfully reduced paper communications with providers, along with associated costs, by instituting automated transaction processing and electronic data interchange initiatives. Physicians are on the receiving end of those electronic transfers in the form of electronic remittance advice (ERA) reports and electronic funds transfer (EFT) receipts, often manually entering the data they contain into practice financial systems.